Calculate my income

If you are early in your career or expect your income level to be higher in the future this kind of account could save you on taxes in the long run. Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP.

4 Ways To Calculate Annual Salary Wikihow

Ad We Offer IRAs Rollover IRAs 529s Equity Fixed Income Mutual Funds.

. Using the steps in the shortcut method to calculate your annual pay. Estimate garnishment per pay period. See your tax refund estimate.

Use the average hours you work each week if your schedule varies. Factors to Help Calculate a Good Retirement Income for You. If you make 55000 a year living in the region of New York USA you will be taxed 11959.

Let us know your questions. It is mainly intended for residents of the US. We know your time is precious so.

Gross income per month 10400 12. When filling out your application youll be shown the expected yearly income. Gross income per month 10 x 20 x 52 12.

That means that your net pay will be 43041 per year or 3587 per month. Although the Quick Calculator makes an initial assumption about your past earnings you will have the opportunity. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you.

Everyone works with a different amount of income during their retirement. Write down the net expected income for coverage year or download and save the PDF. Compare options to stop garnishment as soon as possible.

Enter Your Tax Information. Whatever Your Investing Goals Are We Have the Tools to Get You Started. The total you end up working with.

This calculator is always up to date and conforms to official Australian Tax Office rates and. Find out how many hours you work each week before calculating your annual income. If the amount shown is.

The Income Tax Calculator estimates the refund or potential owed amount on a federal tax return. And is based on the tax brackets of 2021 and. Gross income per month 86670.

Income Calculator Explore and understand your investment options. Next add three zeros to the end of the number from the first step. Ad Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes.

For example if a person made. Use this calculator to quickly estimate how much tax you will need to pay on your income. As your total income goes up youll pay federal income tax on a portion of the benefits while the rest of your Social Security benefits remain tax-free.

First double the hourly pay. Well calculate the difference on what you owe and what youve paid. Another popular rule suggests that an income of 70 to 80 of a workers pre-retirement income can maintain a retirees standard of living after retirement.

You can easily convert your hourly daily weekly or monthly income to an annual figure by using some simple formulas shown below. Ad E-File your tax return directly to the IRS. So benefit estimates made by the Quick Calculator are rough.

Whether youre growing your investments or saving for retirement use our tools to get the confidence you need to reach. Pay Your Income Tax Error-Free With An Online Income Tax Calculator. To convert to annual income.

If youve already paid more than what you will owe in taxes youll likely receive a refund. See What Credits and Deductions Apply to You. You will be able to.

Besides paying 11888 tax the government will also tax your employer because. Financial Calculator has standalone keys for many financial calculations and functions making such calculations more direct than on standard calculators. How Your Paycheck Works.

Ad Takes 2-5 minutes. Once you start using a good income tax calculator online you will realise its numerous benefits. Prepare federal and state income taxes online.

Gross income per month 10 x 1040 12. Next multiply the number of hours. To put it numerically you will be charged with a 364 marginal tax rate and a 216 average tax rate in Maine.

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

What Is My Tax Bracket 2021 2022 Federal Tax Brackets Forbes Advisor

Agi Calculator Adjusted Gross Income Calculator

Taxable Income Formula Examples How To Calculate Taxable Income

3 Ways To Calculate Your Hourly Rate Wikihow

Net Worth Calculator Find Your Net Worth Nerdwallet

Salary Formula Calculate Salary Calculator Excel Template

What Is Annual Income How To Calculate Your Salary Income Financial Health Income Tax Return

How To Calculate Taxable Income H R Block

How To Calculate Net Pay Step By Step Example

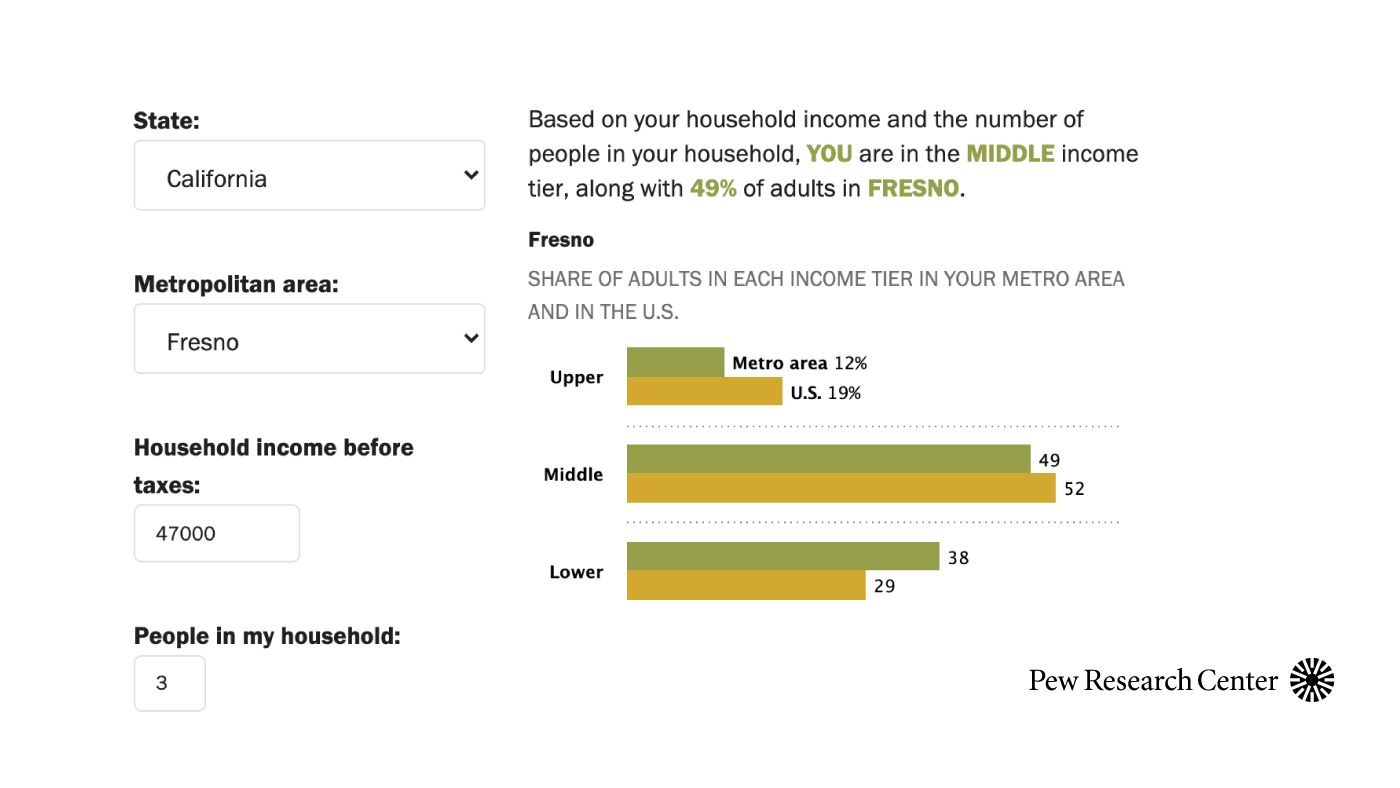

Are You In The U S Middle Class Try Our Income Calculator Pew Research Center

Income Percentile Calculator For The United States

How To Calculate Gross Income Per Month

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Annual Income Calculator